Depending on your type of business, you might need wire transfers quite often or not at all. Wire transfers tend to involve a lot of money that must be sent on a certain date. If you run a retail business, most daily activities won’t require that. But if you’re a manufacturer or are a wholesaler, then you’re probably dealing with wire transfers often. And if you deal with wire transfers often, we think it might be useful for you to understand a little bit how wire transfers work.

If you wire money often, you know that the fees can be expensive compared to, say, credit card processing fees. This is especially true if you do international wire transfers, where sometimes you won’t know the exact fee until the money gets to the destination bank.

Why are the fees so expensive? To get a better idea of the whys, it helps if you have a general understanding of how wire transfers work and how it differs from, say, ACH transfers. And once you do understand the difference, you might be able to switch from using the more expensive wire transfer to the cheaper ACH transfer.

Let’s take a closer look at the mechanics of wire transfers.

How Banks Transfer Money

To understand how wire transfers work, you’ll need to first understand how banks transfer money to each other. There are basically two methods: the correspondent bank method and the central bank method. We explained these methods in an earlier article. Here’s the link that takes you directly to that section. You really do need to understand these methods before the rest of this article will make sense to you.

Some money transfers only use one type of method. For example, ACH transfers only use the central bank method. But wire transfers use both the correspondent bank method and the central bank method. Sometimes, both are even used together.

What’s more, with most countries, there’s usually one method used for domestic wire transfers and another method used for international transfers. Since our readers are mostly located in the US, we’ll go over the details of how US domestic wire transfers work below. Then, we’ll go over how international wire transfers work.

How Domestic US Wire Transfers Work: Three Paths

In the US, banks wire money to each other using both the correspondent bank method and the central bank method. Under the central bank method, you can use Fedwire or CHIPS.

Correspondent Banking

It’s hard to compile a list of banks using correspondent banking with each other. This sort of business relationship isn’t publicized. But banks absolutely do use this method when the opportunity arises.

Fedwire

Fedwire is a service of the Federal Reserve banks. A Fedwire transfer uses the central bank method.

As long as the bank you’re transferring from and the bank you’re transferring to both have accounts at the Federal Reserve, then they can access the Fedwire service. Right now, there are more than 9,000 banks that have accounts for the Fedwire service.

All Fedwire transfers are in real time and are final. The recipient of the money has access to the money right away.

The Federal Reserve does charge a small fee for the service. The fee is based on the amount transferred. Any additional fees you pay for the wire is from your bank. (Some banks waive the fee if you have an account with a high enough deposit.)

CHIPS

CHIPS stands for Clearing House Interbank Payment System. It is a wire transfer network owned by The Clearing House, which is a banking organization owned by a lot of the biggest banks in the world.

As of this writing, there are 47 banks around the world who can perform CHIPS transfers. Banks who are not members of CHIPS but who wish to use this network must perform the transfer through one of the member banks.

All CHIPS transfers use the central bank method and are final. But, unlike Fedwire, CHIPS is a netting system. So, the actual transfer is not instantaneous but is somewhat delayed (click on the “How it Works” link for the flow chart).

CHIPS transfers cost less than Fedwire, and you can perform select international wire transfers through CHIPS.

How International Wire Transfers Work

Most international wire transfers are done through a network called SWIFT. SWIFT stands for Society for Worldwide Interbank Financial Telecommunication. They’ve been operating since 1973, and they’re based in Belgium.

SWIFT is basically a group of banks that do business with each other. There are more than 10,000 member banks in SWIFT. They transfer payment messages through a network of computers using a specific communications protocol. (A communications protocol is like a computer language but is used for computer networks.)

Banks in the SWIFT network mostly transfer funds using the correspondent bank method. So, each bank in the SWIFT network is connected to at least one other bank in the network.

Because SWIFT uses the correspondent bank method, sometimes, an international transfer will go through several banks before getting to the destination bank. Each bank will charge a handling fee. This is why the cost of a SWIFT transfer often can’t be determined beforehand.

SWIFT transfers are real-time transfers—i.e. money is transferred between two banks right away. However, since it can take several banks to get to the destination bank, it’s also difficult to predict when a SWIFT transfer will be completed.

Do You Always Need a Bank to do Wire Transfers?

Even though most, if not all, banks can perform wire transfers, you don’t always have to go to a bank to wire money to someone. In fact, banks didn’t invent the term wire transfer. Western Union was the first to use the term, although the method the money was transferred was different. Western Union continues to help customers perform wire transfers even today.

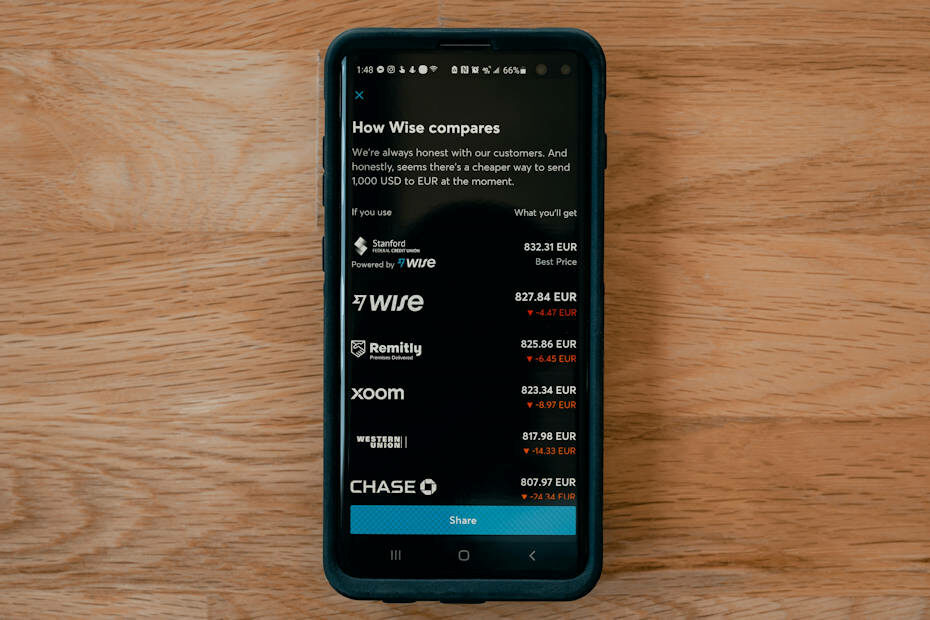

Other businesses far younger than Western Union also help both ordinary consumers and businesses wire money. One such company is Wise (formerly Transferwise). Wise is a fintech company that’s focused on less expensive international wire transfers.

Here’s our detailed article on B2B wire transfer providers, if you need more information on pricing.

While Wire Transfer is the Traditional Method, ACH is Catching Up

Traditionally, if you must send a large amount of money on a certain date (and maybe at a certain time), then you use a wire transfer. There is no upper limit on a wire transfer, and, once the transfer is done, typically there is no way to pull the money back.

Because businesses often must buy or sell in large amounts, some businesses must use wire transfers to conduct most of its business. This is especially true in international commerce.

But things are quietly changing, at least in the US. Now, ACH transfers can be performed on the same day, for amounts up to $1 million. More and more, ACH is encroaching into the territory of traditional wire transfers.

So, if you run a business that currently uses a lot of wire transfers, be sure to keep your eyes open for newer choices. ACH transfers are becoming more and more viable (and cheaper) than wire transfers each day.

Questions? Comments?